Proxy voting

What is it?

Many publicly traded companies hold shareholder meetings. These meetings are used for reporting activities, discussing financial performance and decision making. This is where the voting comes into play.

Shareholders often have the right and responsibility to vote for any number of items: change in the board of directors, executive pay, re-organisation, etc. Voting on issues is a powerful tool that shareholders have. However, not all shareholders can physically attend the shareholders meetings.

The proxy process or also called the proxy voting is the term used to describe the means for shareholders to participate in a company’s annual shareholders meetings, without attending the meeting.

A proxy vote is in essence of an absentee ballot. It is a vote cast by one person of behalf of another shareholder in the company. Before the meeting, shareholders will receive a packet in the mail called a proxy statement, which covers the issues being discussed and voted upon. In that packet is a proxy ballot that can be filled out and sent back to the company or shareholders requesting the proxy. These votes typically are held once a year in connection with the company’s AGM (annual general meeting for shareholders).

How does it work? – take Allianz Global Investors as an example

We put great effort and care into developing in-house views and positions on corporate governance and proxy voting matters.

Voting decisions are informed by in-depth research, analysis and discussions with investee companies. Detailed proxy voting policies help shape our voting decisions while a robust proxy voting process ensures significant governance. Voting matters, and potential conflicts of interest, are assessed on a case-by-case basis.

Allianz Global Investors is committed to full transparency of its proxy-voting activities and maintain real-time disclosure of all votes cast, including commentary on votes against management and abstentions.

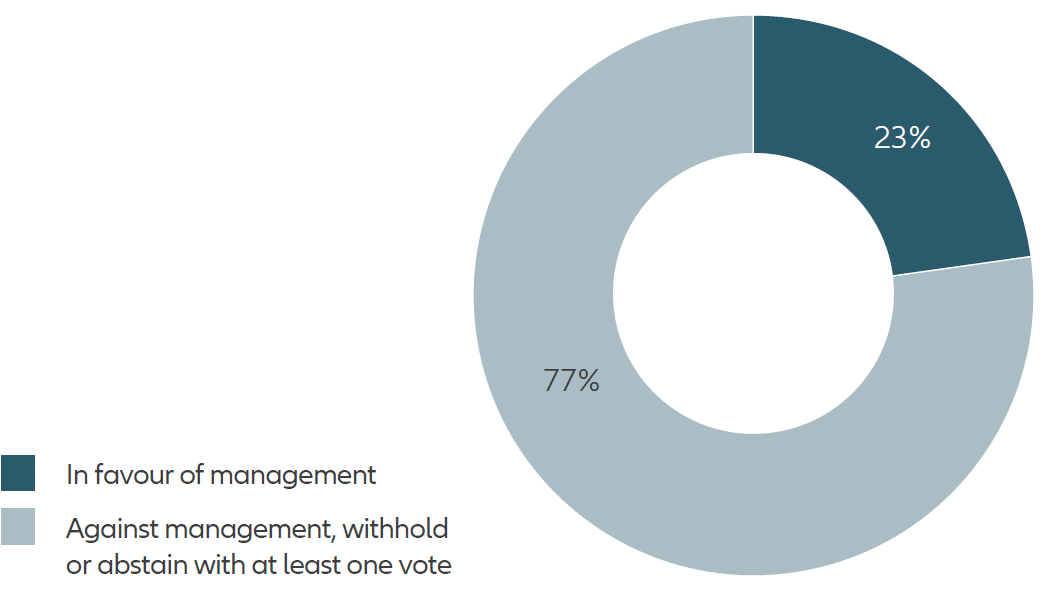

During 2019, Allianz Global Investors participated in 9,532 shareholder meetings (8,535 in 2018) and voted against, withheld or abstained from at least one agenda item at 77% of all meetings globally (75% in 2018). We opposed 24% of all resolutions globally (24% in 2018). These figures reflect our highly active and globally consistent approach to stewardship and a willingness to vote against proposals that do not meet our expectations.

Voting in 9,532 shareholder meetings in 2019

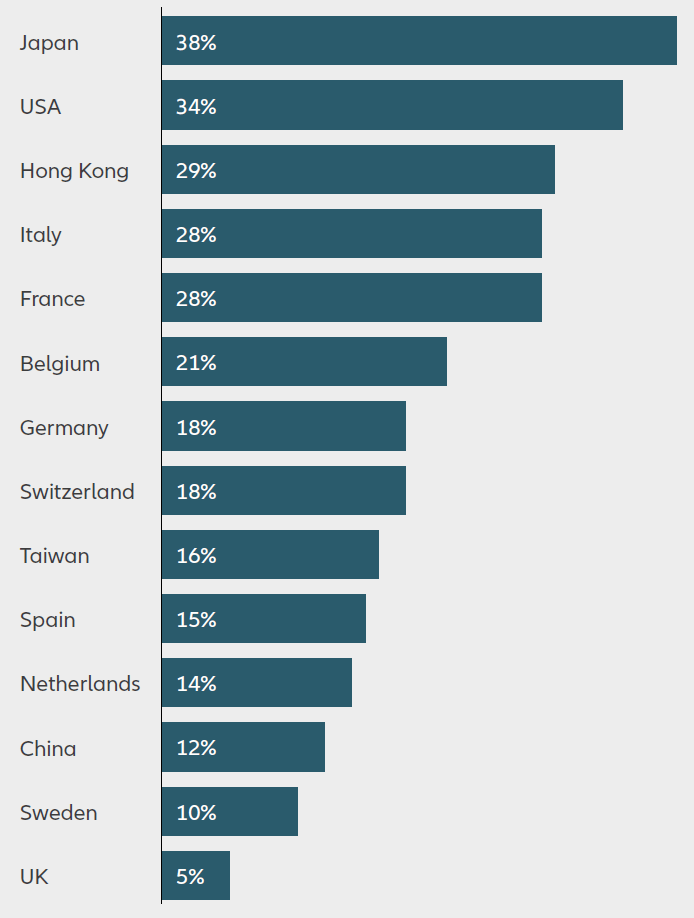

Total percentage votes against all management proposals by market in 2019

What’s the outcome?

Proxy voting enables asset managers to vote during shareholder meetings on behalf of their investors. This allows asset managers to have a say on important issues affecting companies they are invested in.

Source: Allianz Global Investors; Sustainability Report 2019; April 2020.